Gravestone Doji Candlestick Trading Strategy Explained

They are shaped like an upside-down T with a slim real body and signify a possible reversal to the downside. Look for the price to fall below this candle to confirm the reversal. The Gravestone Doji Candlestick Pattern is one of the fabulous and versatile patterns in trading. Some traders, use this pattern in their daily lives to learn about the feel of the market. The article is about the Gravestone Doji pattern, its purpose, use, and how traders integrate it into their trading plans.

How to Trade the Doji Candlestick Pattern – DailyFX

How to Trade the Doji Candlestick Pattern.

Posted: Fri, 07 Jun 2019 07:00:00 GMT [source]

The candle may or not have a wick at the bottom, but if it has, must be small. First, look at the highest point of the Doji and see whether there is a special relationship. You can do this by looking at the existing chart or another timeframe. On the chart above, since there is no immediate relationship, we checked any relationship on the weekly chart. As you might have guessed from their opposing structures, Dragonfly and Gravestone Doji also have opposing implications.

Limitations of the Gravestone Doji

We have a basic stock trading course, swing trading course, 2 day trading courses, 2 options courses, 2 candlesticks courses, and broker courses to help you get started. Our chat rooms will provide you with an opportunity to learn how to trade stocks, options, and futures. You’ll see how other members are doing it, share charts, share ideas and gain knowledge.

Therefore, to identify the right gravestone doji, we recommend two things. Partially close the trade at 61.8% Fibonacci level of retracement wave and close the rest of the trade at the origin of retracement wave. Delete pending order in case if the order does not get filled after two further candlesticks formation.

What is the Gravestone Doji Candlestick Pattern?

Therefore, the bullish advance upward was rejected by the bears. The second step is to identify when the gravestone doji pattern happens. As you can see, the price reversed when the Doji pattern happened. The only notable difference is that the shooting star pattern has a https://g-markets.net/ small body while a gravestone doji has no body. The important and interesting fact of the Gravestone candlestick is that high of this candlestick acts as a strong resistance level. If it forms within a range of candlesticks then it will represent a sideways range only.

As a bearish reversal pattern, the Gravestone Doji is a great pattern to watch for when the price is on a downtrend. A gravestone doji can happen in both a bull run and a bearish trend. When it happen in gravestone doji candlestick an uptrend, the price normally opens and then shoots upwards and then drops and closes at the opening price. A gravestone doji happens when a candle opens, rises, and then ends at exactly at the point.

Gravestone Doji

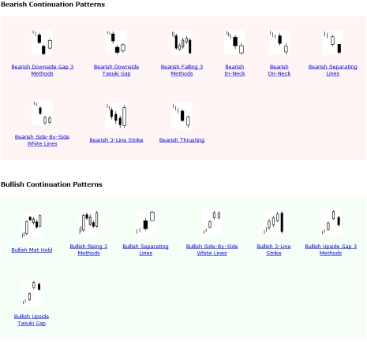

Two major types of technical analysis are reading chart patterns and statistical indicators. With the latter, technical analysts use mathematical formulas on prices and volumes to create moving averages that smooth out price data and make it easier to spot trends. Technical analysts also look at moving average convergence divergence (MACD). They are typically found in up trends signifying a potential reversal to the downside. They have a small flat real body, longer upper wick, and look like an upside-down T. When the price of a security has shown a downward trend, it might signal an upcoming price increase.

- Gravestone Doji candlestick pattern has the same opening and closing price.

- It represents a bearish pattern during a reversal that will be followed by a downtrend in price.

- We teach day trading stocks, options or futures, as well as swing trading.

- This will give the trade more confirmation of the bears applying pressure on the uptrend.

OHLC is simply a short-hand for representing the “Open, High, Low, Close” of the doji candlestick. We will discuss an example of “story derivation” and OHLC Analysis of a Gravestone Doji Candlestick in the next section of this article. It is typically used alongside other technical indicators to confirm the possibility of an upcoming downtrend. A candlestick having longer wicks means that the stock experienced greater price volatility during that day. To know a stock’s price range over the course of a day, all an investor has to do is subtract the lowest price from the highest price. As to the appearance, the neutral doji differs in that it has a lower and upper wick, which is not the case with the gravestone doji.

What the Gravestone Doji pattern tells traders?

It’s high, open and close prices are all the same level instead of low, free, and close rates. In Gravestone Doji Patterns, the trader follows the uptrend; on the other hand, in Dragonfly Doji Pattern, a trader follows the downtrends. As such, it could be a trend reversal indicator or a trend continuation signal. To ensure it is a reversal signal, we added the Relative Strength Index (RSI) indicator and the Moving Average Convergence Divergence (MACD). Further, when trading the bearish gravestone candle pattern, a stop loss should be placed above the highest level of the gravestone candle.

This opens up to two types of selling signals, a weak signal, and a strong signal based on where the patterns appear. Let’s look at an example of a gravestone doji with a resistance level. For example, if you saw a gravestone doji on a 1-week chart, that will provide a stronger indication of a reversal, much more than a gravestone doji appearing on a 15-minute chart. It is well-known for amateurs to identify a gravestone doji in an open trading session, so they usually trade as soon as they identify it.

The Gravestone Doji is a single candlestick pattern that signals a trend reversal. It is one of the different types of the famous Doji candlestick pattern and is usually formed at the end of an uptrend. Traders and investors generally use this chart pattern to identify price reversal and enter a position at the beginning of a new trend. The Gravestone Doji candlestick pattern can be interpreted as a bearish reversal when it occurs at the top of uptrends. The Gravestone Doji can help traders see where resistance to a pricing increase is located. It is typically used with other technical indicators to identify a possible uptrend.

What is Doji candle pattern in crypto and how to trade with it? – CoinGape

What is Doji candle pattern in crypto and how to trade with it?.

Posted: Wed, 15 Feb 2023 16:31:59 GMT [source]

To learn more about divergences, we suggest you download our divergence cheat sheet. In addition, it is similar to the dragonfly Doji and has an inverted T letter, which suggests that buying or selling pressure stops. Some people refer to the gravestone doji as the “tombstone doji“. Just think of the buyers being able to continue a trend higher to a particular high in the market.